10 dollars an hour 40 hours a week after taxes

If creating each item along with managing supply inventory interacting with customers then shipping the items takes her 2 hour then this comes to 10 per hour. You can enter regular overtime and other pay per hour.

Taxes In Belgium A Complete Guide For Expats Expatica

This result is obtained by multiplying your base salary by the amount of hours week and months you work in a year assuming you work 375 hours a week.

. 12 To calculate how much 1050 an hour is per year we first calculate weekly pay by multiplying 1050 by 40 hours per week and then we multiply the product by 52 weeks like this. All Topics Topic Science Mathematics If I make 1000 an hour 40 hours a week how much will I net after taxes. See where that hard-earned money goes - Federal Income Tax Social Security and other deductions.

If she sells about 2 items a week for 36 each spends 5 on shipping each item out has a 11 cost of goods for each item then her profit is 20 per item or 40 weekly on average. 401k403b plan withholding. Annual salary 3120000 Monthly salary 260000 Weekly salary 60000.

So 52 into 40 is 2080 hours per year. Paying a tax rate of 25 and working full-time at 40 hours a week you would earn 780 after taxes. How much money is 10 per hour.

That adds up to 1392638 per year or just over 1150 per month. Assuming 40 hours a week that equals 2080 hours in a year. To calculate your yearly income before taxes you have to multiple 52 weeks by the number of hours you work per week 40 and then multiply that number by 20.

1050 40 hours 42000 per week 42000 52 weeks 2184000 per. 10 an Hour is How Much a Week. 2080 hours into 20 is 41600 per year.

Please note these numbers are exclusive of income tax. 13 dollars an hour for 40 hours 1340 520 dollars per week. If you know your tax code you can enter it or else leave it blank.

If you make 10 an hour how much do you make a week after taxes. Enter any payroll deductions made by your employer that are made with after-tax income. If I make 20304 on disability for the year and 25636 with the PUA after having 10 taken out each check filing single with dependent.

40 hours multiplied by 52 weeks is 2080 working hours in a year. Your hourly wage of 10 dollars would end up being about 20800 per year in salary. Work hours per week.

To calculate how much 1710 an hour is per year we first calculate weekly pay by multiplying 1710 by 40 hours per week and then we multiply the product by 52 weeks like this. So if you work 50 weeks you will make 52050. There city income tax.

A normal year is 52 weeks and 1 day a leap year is 522. To calculate how much you will get paid per year lets assume you work 52 weeks of the year with 2 weeks paid time off. 68400 per week.

The commonly cited minimum wage annual salary for a 40-hour-a. For example 3 days plus 4 days is 7 days which divided by 2 is 35 days in their average work week. Assuming you work 40 hours a week you would get 2 weeks of paid leave.

In 2017 each allowance you claim is equal to 4050 of income that you expect to have in deductions when you file your annual tax return. Please enter a dollar amount from 1 to 1000000. Assuming 40 hours a week that equals 2080 hours in a year.

Wild guess 320 dollars give or take depending on. An employee receives a hourly wage of 15 and he works 40 hours per week which will result in the following earnings. 1050 Work hours per week.

But if you get paid for 2 extra weeks of vacation at your regular hourly rate or you actually work for those 2 extra weeks then your total year now consists of 52 weeks. For the pay period. To calculate how much you make biweekly before taxes you would multiply 10 by 40 hours and 2 weeks.

Overtime pay per year. This amount is calculated by assuming you work full-time for all four weeks of the month. Annual salary hourly wage hours per week weeks per year For guidance a standard working week for a full-time employee is around 40 hours.

40 Work weeks per year. I would like to break even or owe a little at. The weekly take-home pay for a 40-hour-a-week minimum-wage employee after Social Security and Medicare taxes.

If you multiply 40 hours by 10 an hour you get 400 your weekly income. How much is 10 an hour after taxes. If you do any overtime enter the number of hours you do each month and the rate you get paid at - for example if you did 10 extra hours each month at time-and-a-half you would.

The number of allowances you should claim depends largely. Work weeks per year. Each of the pay per hour entry fields has its own hours worked.

68400 52 weeks. Your hourly wage of 50 dollars would end up being about 104000 per year in salary. The following table shows what the pretax biweekly earnings for 20 30 40 hour work weeks for various hourly salaries.

The Hourly Wage Tax Calculator uses tax information from the tax year 2022 to show you take-home pay. 13 per hour multiplied by 2080 working hours per year is an annual income of 27040 per year. Note that if you take two weeks of unpaid leave per year your number of weeks will be 50 rather than 52.

In case someone works in a week a number of 40 regular hours at a pay rate of 10hour plus an 15 overtime hours paid as double time the following figures will result. Dec 7 2010 0502 PM If I make 1000 an hour 40 hours a week how much will I net after taxes. But if you get paid for 2 extra weeks of vacation at your regular hourly rate or you actually work for those 2 extra weeks then your total year now consists of 52 weeks.

My next question is the city Im in Im currently paying 19 federal tax at 16 before it was 22 at 1650. If you make 10 an hour you will get paid 400 a week. In the Weekly hours field enter the number of hours you do each week excluding any overtime.

If you are working a full-time job you will be working 40 hours per week on average. 1710 40 hours. To calculate how much you make biweekly before taxes you would multiply 13 by 40 hours and 2 weeks.

Overtime pay per period. If you make 10 per hour your Yearly salary would be 19500. More information about the calculations performed.

Example of a result. Tax rates vary depending on your exemptions the country statecounty and even city that you are working in. 52 Income Tax Rate.

How To Pay Little To No Taxes For The Rest Of Your Life

27 500 After Tax 2021 Income Tax Uk

4 160 A Month After Tax Us February 2022 Incomeaftertax Com

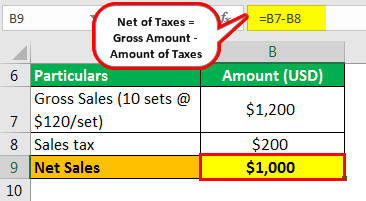

Net Of Taxes Meaning Formula Calculation With Example

Gross Income Formula Step By Step Calculations

Accounting For Income Taxes Under Asc 740 An Overview Gaap Dynamics

What Are Earnings After Tax Bdc Ca

What Are Itemized Deductions And Who Claims Them Tax Policy Center

7 Incredible Ways To Make An Extra 600 Fast Life And A Budget Make Money Blogging Earn Extra Cash Make More Money

Account Suspended Funny Quotes Taxes Humor Accounting Humor

German Wage Tax Calculator Expat Tax

What Are Itemized Deductions And Who Claims Them Tax Policy Center

How Much In Taxes Is Taken Out Of Your Paycheck Morningstar

Top 10 Income Tax Courses In India 2022 Updated

Employment Contract Definition What To Include Contract Template Employment Letter Of Employment

States With The Highest And Lowest Property Taxes Property Tax High Low States

2021 2022 Tax Brackets Rates For Each Income Level